In recent years, Estonia has quietly become one of the most attractive launchpads for global entrepreneurs seeking an EU base. Thanks to its digital-first infrastructure, favorable tax regime, and the e-Residency program, many business founders are choosing Estonia as their gateway into the European Single Market. Below, we explore why — with data, context, and insights from building Capture.

Momentum: E-Residency by the numbers

Estonia’s official e-Residency dashboard reports that there are now 129,500+ e-residents globally, with 37,400+ Estonian companies formed by these digital residents.

In the first half of 2025, 2,634 new companies were registered by e-residents — an 8% year-on-year increase.

Meanwhile, e-residents’ demand for local services is rising: In 2024 alone, they generated €15.5 million in revenue for Estonian service providers (up 36% from the previous year).

What makes Estonia so compelling?

Here are the key drivers behind the trend:

| Feature | Why it matters |

|---|---|

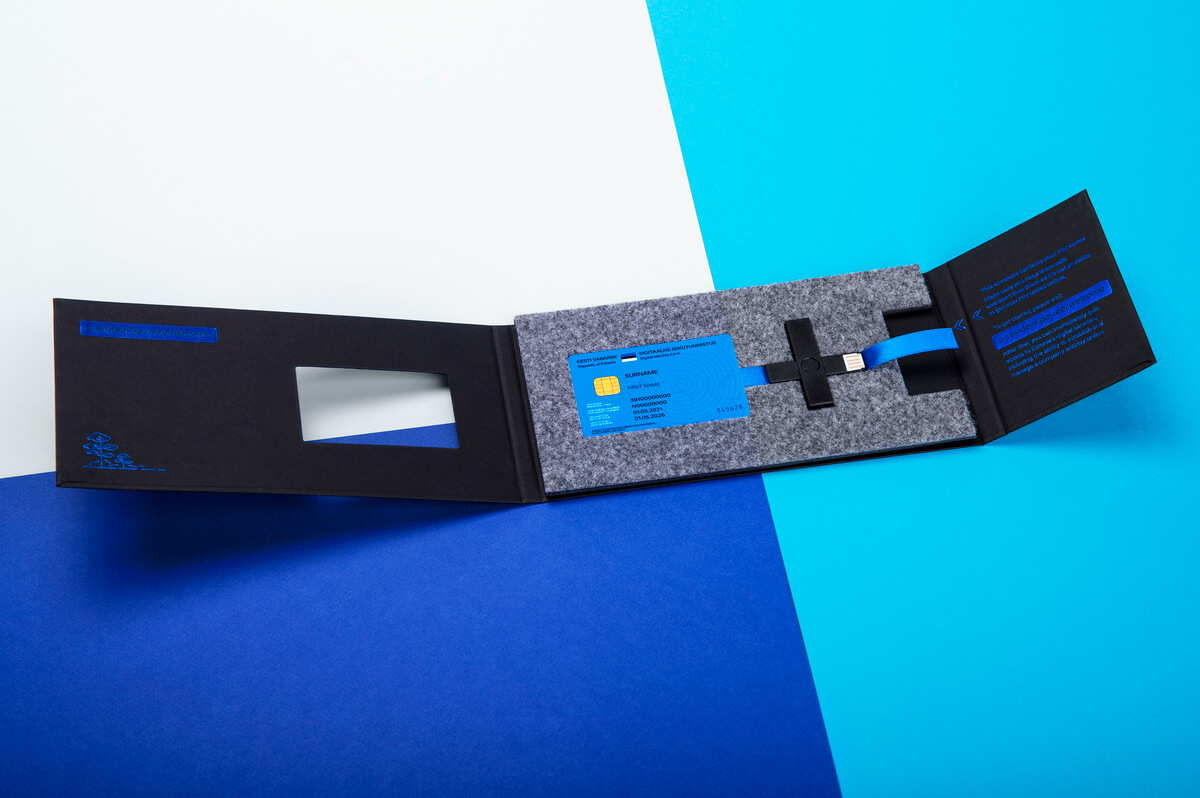

| All-digital backend | You can register, file, sign documents, and manage compliance entirely online with your eID — no physical presence needed. |

| Tax policy | Your company is within the EU’s legal and payment framework from day one. |

| EU membership + Eurozone access | Strong brand/trust |

| Strong brand / trust | Having an EU-registered entity helps with credibility among European customers and partners. |

| Scalable support ecosystem | As the e-Resident community grows, service providers (such as legal, accounting, and virtual office services) scale in parallel — making support easier to access. |

Due to these advantages, many entrepreneurs from outside the EU view Estonia as a “stepping stone” into European markets with relatively low friction.

Challenges & caveats to watch

Of course, Estonia isn’t a magic bullet. Some issues founders should weigh:

- Tax residence and permanent establishment (PE) — even if your company is Estonian, your home country might still tax business activity if it deems that “operational control” occurs where you reside.

- Banking friction — some jurisdictions and banks are cautious about accounts owned by nonresidents.

- Sector regulation — specific industries (fintech, payments, crypto) carry extra regulatory burdens, especially cross-border.

- Overreliance on third-party providers — using an address provider or “nominee” contact person doesn’t replace real substance or compliance.

Capture’s perspective & how we see the future

At Capture, we’ve watched this trend from close up. We believe the shift is here to stay, and we’re building our infrastructure around it:

- We design our signup and service offering for ultra-low friction so founders can get in and get started quickly.

- We price transparently, combining address, contact person, and formation (as outlined in our annual plan) — so you don’t need to worry about hidden “setup” surprise fees.

- We view our role not just as a virtual office but as a compliance anchor — helping clients stay legally aligned while they scale across borders.

Final Thoughts

Entrepreneurs are choosing Estonia not just for what it offers today, but for what it signals: Speed, legitimacy, flexibility, and access. The data backs it up. As Estonia refines its digital offering and the global economy continues decentralizing, more founders will view it as a launchpad — not just an option.

If you’re looking to test the waters or establish a European presence, Estonia is no longer a fringe choice; it’s rapidly becoming a default one.