Running a company in Estonia comes with a unique obligation: every private limited company (OÜ) is required to file an annual report with the Estonian Business Register. Unlike in many countries, these reports are not kept behind closed doors. Instead, they are made publicly available online for anyone to access.

At first, this might feel unusual or even uncomfortable for founders coming from jurisdictions where company accounts are private. However, Estonia’s approach to transparency is one of the reasons its business environment is so highly regarded worldwide.

What Is an Annual Report in Estonia?

An annual report is a structured overview of your company’s financial activity for the previous financial year. It typically includes:

- Balance sheet

- Profit and loss statement

- Notes to the financial statements

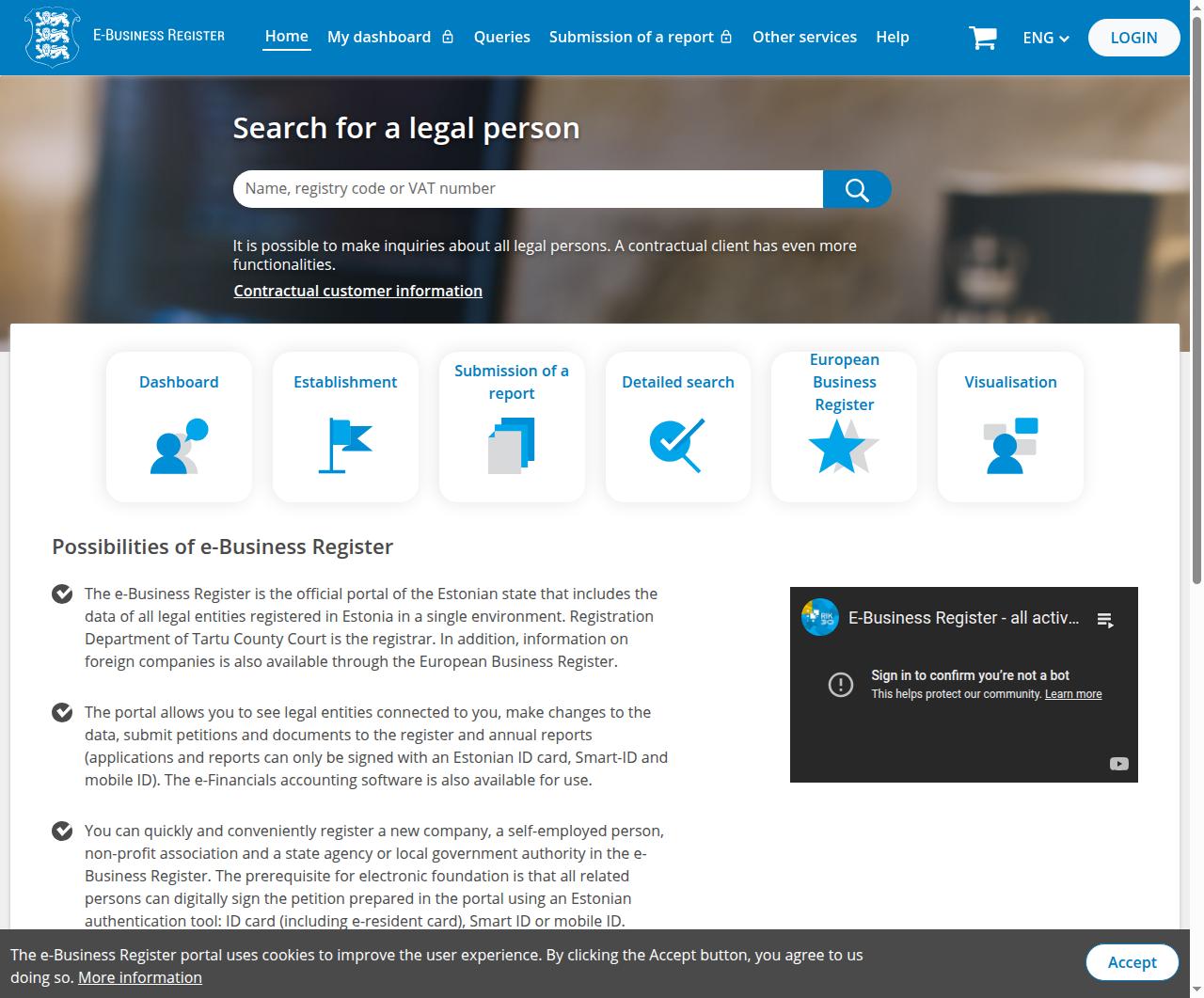

For micro and small businesses, Estonia makes this process straightforward with simplified formats available through the e-Business Register.

Deadline: Annual reports must be filed within six months after the end of the financial year. For most companies using a calendar year, this means by June 30.

Why Are Annual Reports Public in Estonia?

The principle is simple: trust through transparency. By making company data publicly available, Estonia ensures:

- Trust between businesses – anyone can verify if a company is real, active, and compliant.

- Investor and partner confidence – transparency reassures partners, banks, and suppliers.

- Level playing field – no hidden advantages, since financial information is equally accessible.

- Efficient regulation – authorities, auditors, and service providers can instantly cross-check compliance.

This transparency is part of the broader digital-first governance culture for which Estonia is renowned.

How Transparency Helps You as a Business Owner

While the idea of publishing your company’s accounts might feel daunting, in practice it has significant benefits:

- Easier partnerships – potential clients or investors can quickly confirm your company’s status in the Business Register.

- Stronger reputation – compliant companies stand out from those that miss deadlines or fail to file.

- Faster onboarding with banks and fintechs – payment providers and financial institutions often check the Business Register before opening an account.

- Lower suspicion from tax authorities – timely and transparent reporting helps avoid unnecessary scrutiny.

In short, public reporting reduces friction. Instead of back-and-forth document requests, your partners and authorities can self-verify in minutes.

Optional Obligations You Should Know

While every company must file an annual report, other obligations depend on its activity:

- VAT returns (KMD) – if your company is VAT registered.

- Payroll filings (TSD) – if you employ staff or pay board member salaries.

- Statistics reports – in some cases, the Statistics Office may require additional filings.

But if your company has no revenue, no employees, and no VAT registration, then the annual report is typically the only obligation.

Conclusion: Transparency Is a Strength

Estonia’s public annual reports may seem unusual at first, but they’re one of the reasons why Estonian companies enjoy such strong credibility globally. Transparency builds trust, and trust opens doors.

Whether you’re just starting your Estonian OÜ or already running one, keeping up with annual reporting is not just a legal requirement — it’s a business advantage.

Ready to simplify compliance? With Capture’s business address and support services, you’ll never miss an obligation.